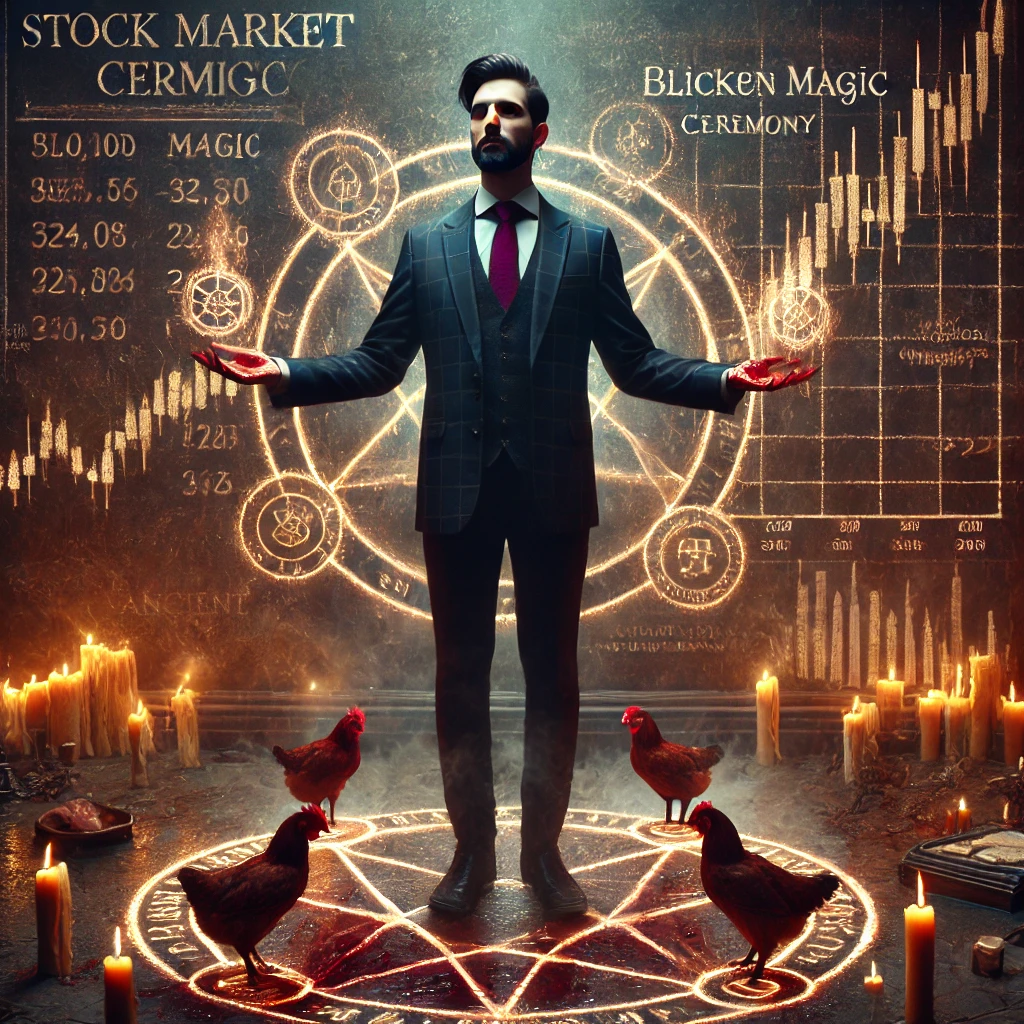

No one believed me when I said I could predict the stock market with chicken blood.

At first, they laughed—“A hedge fund run by a witch doctor?” one analyst sneered. But after my trades consistently outperformed even the best AI models, the laughter turned into whispers. Then came the money.

It all started with a question: What if modern finance had overlooked an ancient, forgotten edge? Wall Street had its algorithms, quantum traders, and insider deals. But deep in the margins of history, before Bloomberg terminals and Fibonacci retracements, traders sought knowledge from sources far older and darker.

So I turned to blood magic.

The Ritual of the Red Candle

At midnight before each trading day, I prepare my workspace—candles burning, incense thick in the air. A live chicken, its fate sealed by the greed of men, waits beside my leather-bound grimoire.

I whisper the invocation, a chant learned from an old manuscript, part Aramaic, part something unpronounceable. The chicken’s blood spills onto the market board, where I’ve drawn the tickers of my key holdings. The patterns of splatter hold the future.

A wide spread with heavy drips? A volatile session, full of sudden reversals.

A slow, thin trickle pooling near the symbol for the S&P 500? A stagnant day, consolidation.

A hard, direct strike near a tech stock? A breakout is imminent.

At first, the signs were crude. But with practice, I refined my readings, cross-checking with historical charts and market sentiment. Soon, I was calling earnings misses before earnings reports, front-running market crashes, and timing Bitcoin’s peaks with eerie precision.

The Day Wall Street Took Notice

It wasn’t long before traders got wind of my unexplainable accuracy. A hedge fund manager from Goldman Sachs approached me discreetly.

“How are you doing this?” he asked, sipping a thousand-dollar scotch.

“Ancient financial analysis,” I replied with a knowing smile.

He offered me a position. I declined. This was bigger than hedge funds. This was the next evolution of trading—arcane finance.

The Price of Power

But blood magic demands balance. I learned the hard way that bad readings come with a cost.

One night, I hesitated. The bloodstains had formed a clear sell pattern on Tesla. But greed clouded my judgment—I held. The next morning, Elon Musk tweeted about selling 10% of his shares. Tesla tanked 12%.

The spirits punished my arrogance. My cat vanished. My reflection in mirrors started moving on its own. A warning.

I no longer question the blood.

The Future of Financial Sorcery

Now, I run the most exclusive trading firm in the world. We don’t use Bloomberg. We don’t use AI. We use the wisdom of the old gods, etched in blood and bone.

And while others debate P/E ratios and CPI reports, I sharpen my blade. Because the market does not obey logic. It obeys sacrifice.