-

Weekly 2 Update

📢 Weekly Portfolio Update: Smart Moves, Strategic Adjustments As we wrap up another exciting week in the StockTrak Challenge, our portfolio has seen strategic shifts focused on risk management, hedging short positions, and stabilizing holdings. Our approach remains measured as we seek to balance growth while ensuring capital preservation. 📌 Key Moves This Week 📊…

-

Building a Risk-Free Portfolio: How We Plan to Protect Our $500K

With 53 days to manage our $500,000 in StockTrak, our goal is clear: never lose money while still making smart, strategic investments. But how do we balance risk and return in such a short timeframe? The answer lies in choosing the right portfolio type—one that minimizes downside while still allowing us to generate steady returns.…

-

Week 1 Report: Getting Our Feet Wet

The first week of the StockTrak challenge has been all about testing strategies, understanding the platform, and managing risk. While we’ve kept a significant portion of our cash uninvested, we’ve made some initial trades to explore different market mechanics. 📌 Team Entries & Updates Julia’s Strategy: Options & Holding for Volatility 🎯 Stock Pick: ULTY…

-

Haunted by doing nothing: Liquidity and the ghost of opportunity cost

Its Day 1 of the President’s Investment Challenge, and we are faced with a dilemma — What to do with our recent windfall of fictitious cash? Keeping it in cash may seem like safe proposition, but we know better than that. Liquidity is costing us money and so we actively weighing our options. the cost…

-

The game has begun – its time to win big!

The presidents investment challenge is officially underway, and this team is gearing up for success! With $500.000USD in virtual capital at our disposal, we are to put our strategies to the test. Our core philosophy? Never lose money. Decisions will be backed by solid analysis, and our combined expertise across multiple disciplines. Whether we divide…

-

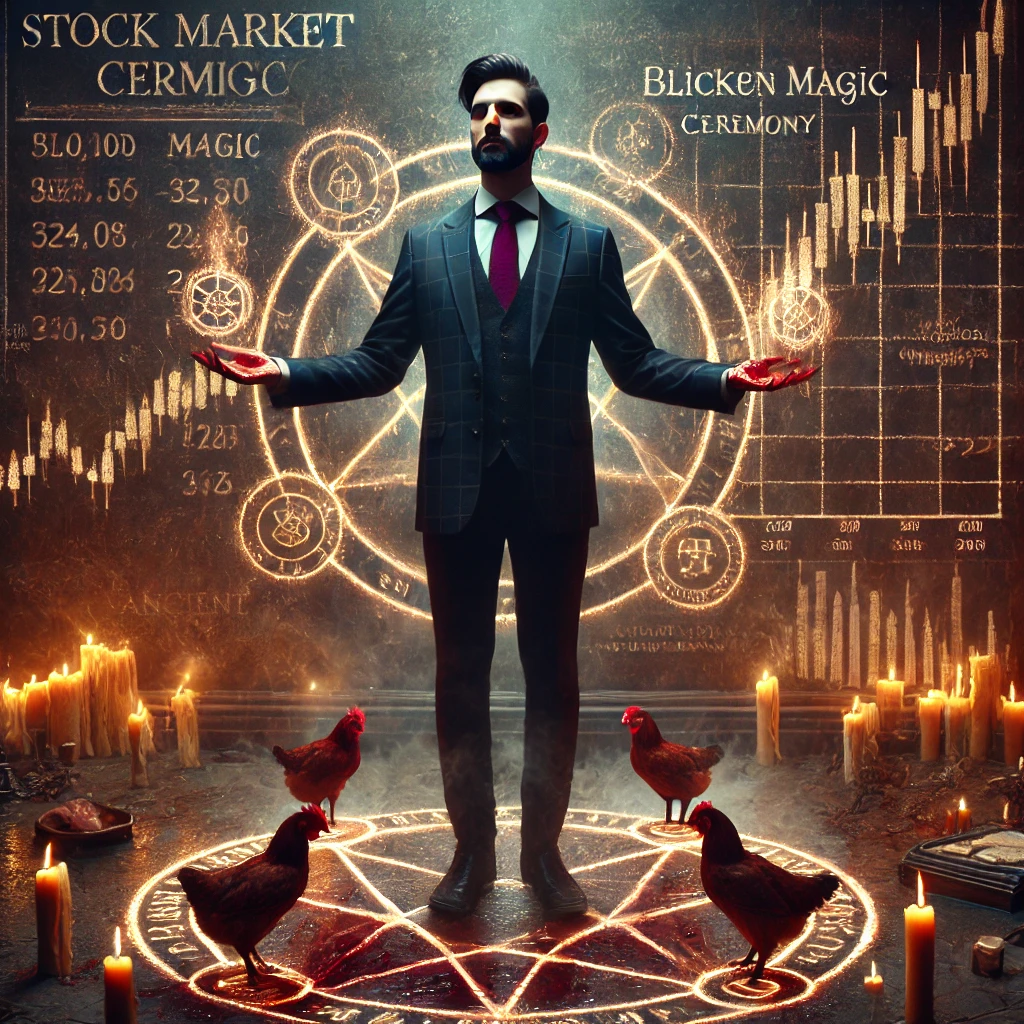

Blood and Bulls: The Occult Art of Market Prediction

No one believed me when I said I could predict the stock market with chicken blood. At first, they laughed—“A hedge fund run by a witch doctor?” one analyst sneered. But after my trades consistently outperformed even the best AI models, the laughter turned into whispers. Then came the money. It all started with a…